Portfolio rebalancing calculator

Optimally rebalance contribute or withdraw money from your portfolio using the Buy and Hold Portfolio Calculator. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Github Cjjeakle Rebalance Calc A Portfolio Rebalancing And Tax Optimization Calculator

Download Our FREE Portfolio Rebalancing Calculator.

. A Portfolio Rebalancing and Tax Optimization Calculator. Ad Get Access To Models From World Class Asset Managers At Reduced Costs. This tools aids you the investor in maintaining your desired asset mix via.

Invest in some of todays most innovative companies all in one exchange-traded fund ETF. It is completely FREE. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

The rebalanced portfolio averaged a 83 return implying an annual rebalancing loss of 125 but also lower risk from 106 to 88 due to a lack of a higher risk equity-shift. Ad Invesco QQQ offers growth exposure to the worlds leading innovative companies. Use this calculator to calculate the changes you need to make to your portfolio for rebalancing.

Ad Invesco QQQ offers growth exposure to the worlds leading innovative companies. Ad Our Resources Can Help You Decide Between Taxable Vs. A Portfolio Rebalancing and Tax Optimization Calculator.

Get Back Hundreds Of Hours And Lower Platform Fees For Your RIA. Shares A B and C are shares that have a higher fair value than the current. So for a 5 asset class.

Asset Allocation Calculator is a ready-to-use tool that you can use to get an appropriate asset allocation. The spreadsheet allows for up to 10 accounts as well as two holdings per asset class. Annual rebalancing is pretty efficient.

A rebalancing calculator such as this one will help you determine which funds you need to buy andor sell and in what amounts to get your portfolio back to your desired. For small asset classes such as one that makes up 5 of your portfolio you rebalance it when it is more than 25 of its allocation out of whack. Thats your portfolios target share allocation for a given ETF.

If youre adding cash to the portfolio simply add the amount youre. Portfolio Rebalancing Calculator Calculate how to rebalance your current portfolio to achieve your target asset allocations Current Portfolio Allocations Asset Name Target Allocation. You can find the rebalance worksheet in our article Here Is The Most Easy To.

The calculator contains the following sheets. The calculator will tell you how much to buy or sell of each investment to reach your target asset allocation. A Portfolio Rebalancing and Tax Optimization.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. For all possible 15 years periods between 1980 and 2011 the rebalanced portfolio was larger than the un-rebalanced one by an average. Take the total value of your portfolio multiply by the desired percentage divide by share price.

If you plan to rebalance without adding any new money enter 0 The spreadsheet. You need to enter your current age level of risk you can take from very low to very. Current investments Equity Amount Debt Amount Gold Amount Desired allocation Equity.

Notes about the calculation procedure. To get closer you must contribute or withdraw a greater amount or perform conventional rebalancing. Invest in some of todays most innovative companies all in one exchange-traded fund ETF.

In our episode titled Stock Market on FIRE. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. What Were Doing in a Downturn Jason mentioned a spreadsheet that he uses.

This calculator will help you stay on target. When youre ready to rebalance enter the amount of new money youre adding in cell D5. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Portfolio value allocation. In the chart above a portfolio of three Fair Value Calculator stocks is put together at the beginning. Rebalancing your portfolio lowers your risk and may provide higher returns in the long run.

Track your mutual funds and stocks investments with this Google Sheet. This calculator considers an. It also incorporates the 525 rule popularized by Larry.

Note that closeness is relative to the target amount.

Free Portfolio Rebalancing Tool Excel Template White Coat Investor

Rebalancing Calculator

Free Portfolio Rebalancing Tool Excel Template White Coat Investor

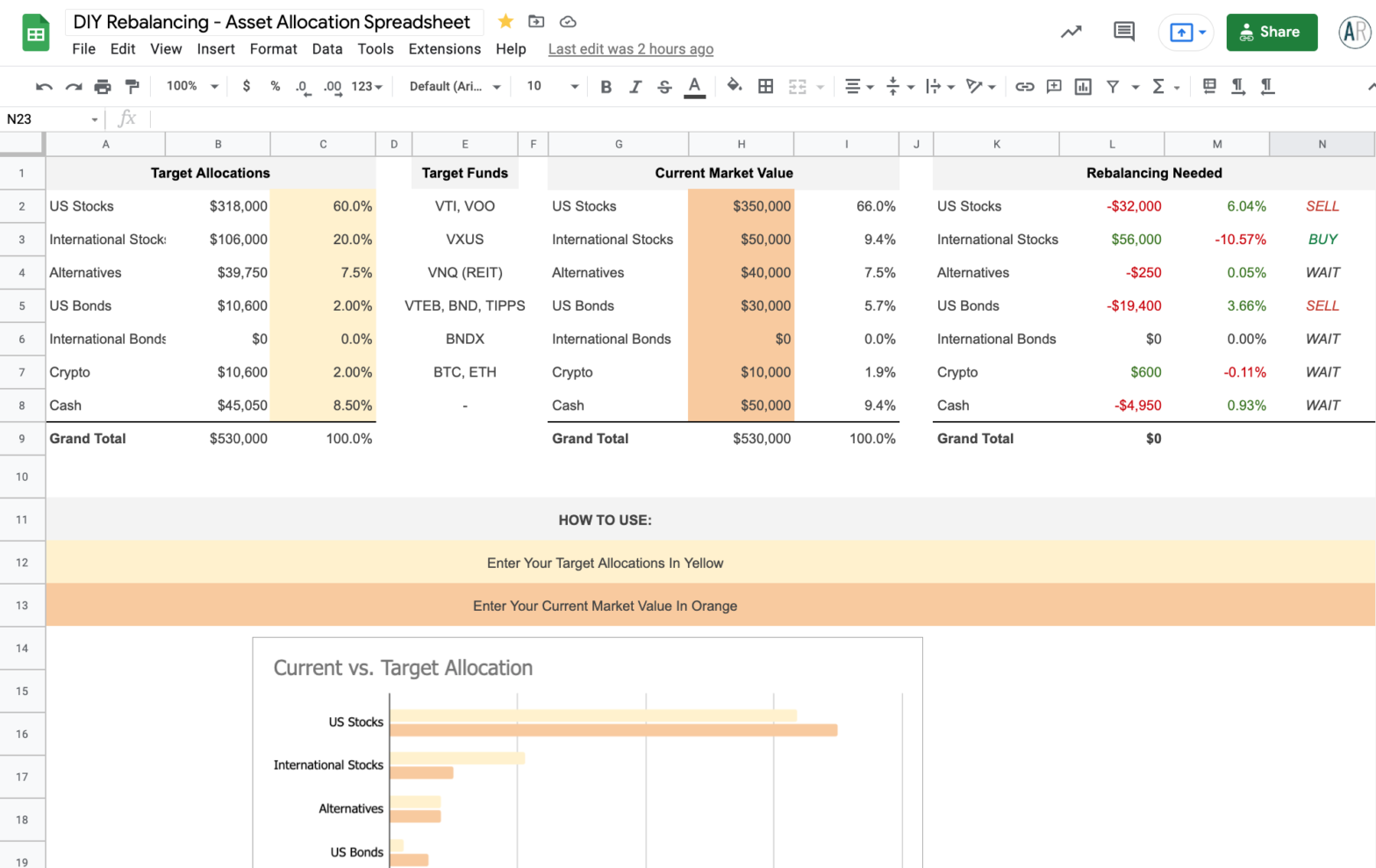

Rebalancing Your Portfolio With An Asset Allocation Spreadsheet

Best Investing Podcasts Investing Podcasts Investment Portfolio

The Amazing Rebalancing Spreadsheet Tars R Ausfinance

Interactive Brokers View Interactive Brokers Investing Positivity

Here Is The Most Easy To Use Portfolio Rebalance Tool Portfolio Einstein

Free Portfolio Rebalancing Tool Excel Template White Coat Investor

Free Portfolio Rebalancing Tool Excel Template White Coat Investor

Simple Hfea Rebalance Calculator Google Sheets R Letfs

How We Rebalance Our Portfolios Download Our Free Tool Youtube

Free Portfolio Rebalancing Tool Excel Template White Coat Investor

Rebalancing Calculator

Smart Account Choices Juice Long Term Growth Financial Iq By Susie Q Interest Calculator Accounting Financial Decisions

Portfolio Rebalancing Calculator Tool On Mechmoney Com Youtube

Rebalancing Calculator